Key Benefits of Investing in Mutual Funds

Are you thinking about your financial future and how to plan effectively? Do you wonder where to find the proper guidance for intelligent investments? Professional advice is crucial for selecting suitable investment schemes.

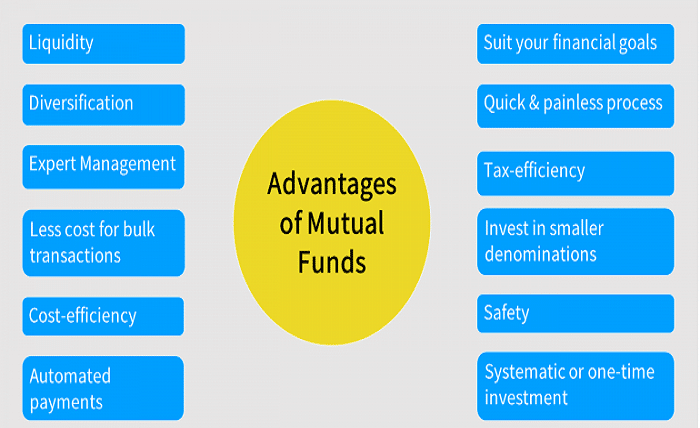

So, what are mutual funds They are investment options that secure money from multiple investors to create a diversified portfolio. Here, we explore the key benefits of investing in these schemes. Let’s learn how these benefits can enhance your financial strategy and assist you in achieving your economic goals.

Diversification: Spreading Risk

One of the most significant advantages of these schemes is diversification. By investing in various securities, these solutions spread risk across different assets. This reduces the impact of any security’s poor performance on your overall monetary allocation. Diversification ensures that your investment is not overly dependent on one type of asset.

Professional Management: Expertise at Work

When you invest in mutual funds, you gain access to professional management. Experienced managers with expertise in market analysis and investment strategies manage these schemes. They make feasible decisions based on thorough market research to maximize returns and manage risks effectively. This can be particularly beneficial for those who lack the time to manage their investments.

Liquidity: Easy Access to Your Money

Systematic investment offers high liquidity, enabling you to trade units at the current NAV. This means you can access your money relatively quickly if needed. Unlike fixed terms, mutual funds offer flexible withdrawals, making them convenient for investors. Understanding what are mutual funds helps you see how this liquidity can benefit your financial strategy.

Affordability: Accessible to All

Investing in these schemes is affordable and accessible, even for those with limited capital. You can begin with a relatively small amount of money. These offer systematic investment plans (SIPs), allowing you to invest a fixed amount regularly. This makes it easier for individuals to gradually build their financial portfolios.

Tax Efficiency: Potential Tax Benefits

These schemes can offer tax efficiency, an attractive benefit for many investors. You may be eligible for tax benefits depending on the fund type and holding period. For example, equity-linked saving schemes (ELSS) offer tax deductions under Section 80C of the Income Tax Act. Long-term capital gains from equity funds may also be taxed lower, enhancing the overall returns.

Transparency: Clear and Regular Updates

Transparency is a crucial feature of these finance management solutions. Fund houses regularly update the scheme’s performance, including detailed reports and statements. This allows investors to track their financial allocation and understand where their money is invested. Such transparency helps make informed decisions and maintains trust in the whole process, as does utilizing the best pay stub generator.

Flexibility: Tailored to Your Needs

These schemes offer options for different monetary goals, risk appetites, and time horizons. Whether looking for growth, income, or capital preservation, you can find an option that aligns with your objectives. This flexibility allows you to create a personalized strategy that aligns with your financial needs.

Diversified Options: Multiple Choices

These solutions provide access to various choices, including equity, debt, hybrid, and sector-specific options. This variety lets you choose schemes based on your preferences and market outlook. This allows you to balance risk and return according to your financial plan.

Potential for Higher Returns: Growth Opportunities

These schemes can deliver higher returns than traditional savings instruments. Equity mutual funds, in particular, offer the opportunity for notable capital appreciation over the long term. Though riskier, the substantial potential rewards make them appealing to growth-seeking investors.

Regular Income: Steady Cash Flow

Specific options like income and dividend yield schemes are designed to provide regular income. These schemes invest in securities that pay dividends or interest, offering a steady cash flow. This feature mainly benefits retirees or those seeking a regular income stream from their financial activities.

So, have you gained insight into what are mutual funds and their benefits? As mentioned above, they offer numerous advantages to help you achieve your financial goals. Consult with a professional to make the best choice for your needs. Start investing in these schemes today and secure a brighter economic future.