Screener Hacks to Identify Hammer Patterns Quickly

Some traders often seem to catch market reversals right as they happen. These traders make use of pattern screeners to identify certain signals on charts that help them make quick decisions. One of the clearest signs of a potential bounce is the Hammer pattern, a single candlestick that can flag a possible trend reversal from bearish to bullish.

If you want to learn how to identify these hammer patterns quickly, this article is for you. With the right hacks, you don’t have to look at hundreds of charts to identify these opportunities; you can let technology do the work. Let’s start!

What is the Hammer Pattern?

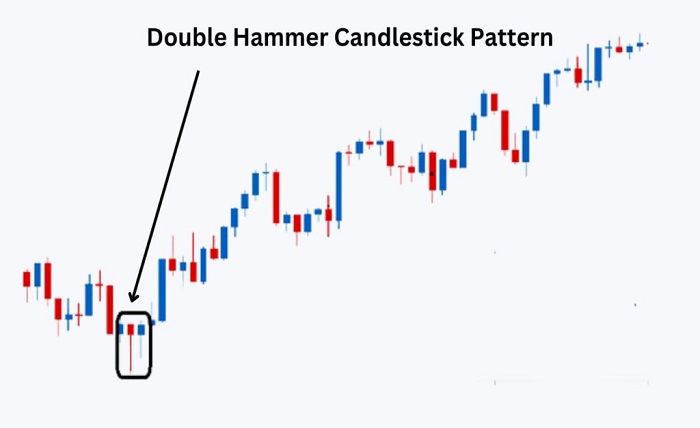

The Hammer candlestick is one of the most popular signals used by traders and investors to spot a trend turnaround. It shows up after a dramatic price drop and looks like a short body perched on top of a long lower wick. This means that sellers pushed the stock’s price down, but buyers came roaring back before the session ended.

A Hammer candle’s lower shadow should ideally be at least twice as long as the body of the candle, with little to no upper shadow. If you see this on a daily or weekly chart, you can take it as a clue that bulls are regaining strength.

A Hammer pattern showing a reversal is important because it can mark the beginning of a new bullish trend. These patterns accurately predict a bounce-back after sharp declines, giving you a second chance to buy the stock at a lower price. Catching this early can help you earn better portfolio returns, provided there’s confirmation with trading volume or another bullish candle.

Screener Hacks: Spotting the Hammer Pattern Quickly

Now, let’s look at some hacks to help you spot these patterns:

Use Dedicated Candlestick Screeners

There are many screeners that will let you set filters that search for Hammer patterns across the stock market in seconds. These screeners scan hundreds of stocks in real-time and highlight only those matching the Hammer structure with the right shadow-to-body ratio.

Set Accurate Parameters

Most screeners allow you to customize your criteria. Here’s a basic parameter to use:

- Real body near the top of the candle.

- The lower wick is at least double the size of the body.

- Minimal or no upper wick.

For example, on some screeners, you can set “candle body” and “lower shadow” parameters so only true hammers pop up, instead of similar-looking patterns.

Scan by Volume and Market Capitalization

Patterns with unusually high volumes, say, at least 1.5x the stock’s average daily volume, often indicate stronger reversals. Many traders add an average volume filter to make sure the Hammer signal isn’t just a fluke. You can also scan only large-cap companies (market cap over ₹10,000 crore) if you want less risk, as these signals on bigger stocks tend to be more reliable.

Check for Confirmation

A single Hammer pattern isn’t enough. You should look for follow-up signals: a bullish candle after the hammer, or a surge in trading volume the next day. Top screeners even let you set alerts for “confirmation bars,” so you don’t have to revisit each chart manually. If the next candle closes higher, it’s usually a stronger signal to buy the stock.

Save, Alert, and Track

The latest screeners let you set daily alerts so the software automatically pings you when a Hammer appears. On some platforms, you can bookmark your filter and get an email or in-app alert the moment a potential reversal stock appears. This is perfect for active traders who don’t want to miss out on intraday opportunities in trending companies.

Conclusion

Using screener hacks to find Hammer patterns is one of the smartest ways to add technical edge to your strategy. Instead of staring at thousands of charts, you can let top market screeners filter and send you only the strongest signals. Always look for confirmation through volume and follow-up candles before making a trade. With the right tools and a clear process, identifying these bullish reversals can turn missed chances into timely wins for investors and traders.