Maximizing Financial Security: A Guide to Retirement Savings Strategies

Key Takeaways:

Identifying various retirement savings strategies is crucial for a secure financial future.

Employer-sponsored small business retirement plans can offer significant benefits to employees.

Contributing early and consistently to retirement plans leverages compound interest for better outcomes.

Ongoing education and financial advice are essential for adapting to changing retirement planning landscapes.

Table of Contents:

Understanding Retirement Savings Options

Setting Financial Goals for Retirement

Benefits of Early and Consistent Retirement Contributions

Evaluating Risk and Investment Options

Understanding Tax Implications and Benefits

Employer Matching and Contributions

Leveraging Professional Financial Advice

Lifecycle Funds and Target-Date Retirement Strategies

Navigating Social Security Benefits

Understanding Retirement Savings Options

The path to a comfortable retirement begins with understanding the savings options available. Participating in small business retirement plans can provide a foundational start for those employed by small businesses. These plans often include 401(k)s or similar vehicles that offer tax advantages and, potentially, employer matching contributions. Additionally, personal savings options like Traditional or Roth IRAs and health savings accounts provide flexibility with different tax implications, complementing employer-sponsored plans. For the more investment-savvy, direct stock purchase plans, real estate investments, and annuities extend the retirement savings palette even further, making it possible to tailor a retirement strategy that fits personal financial goals and risk tolerance.

Understanding each option’s specific benefits and limitations is crucial, such as the tax-deferred growth in traditional IRAs or the tax-free withdrawals in Roth IRAs. For those without access to employer-sponsored plans, setting up an IRA can be vital to securing a financially stable retirement. Moreover, periodically reviewing and reallocating investments across different channels can help manage risk and ensure that the portfolio aligns with changing economic conditions and personal circumstances.

Setting Financial Goals for Retirement

Effective retirement planning hinges on setting realistic and personalized financial goals. Estimating future expenses, considering the impact of inflation, and determining the desired retirement lifestyle are all facets of this crucial step. The goal-setting process also involves creating a timeline for retirement and a savings plan that matches. This often requires diligent budget management, discipline in saving habits, and regular financial goal reassessment to ensure they align with evolving life situations, aspirations, and economic realities.

Financial planning tools or consulting with a financial advisor can provide valuable insights and help refine your retirement strategies. Setting short-term milestones within the larger goal, such as saving specific amounts by certain ages, is also beneficial and can help maintain motivation and track progress. Furthermore, considering potential income sources during retirement, such as social security benefits or part-time work, can provide a more comprehensive view of future financial stability, allowing for adjustments in savings rates and investment choices as needed.

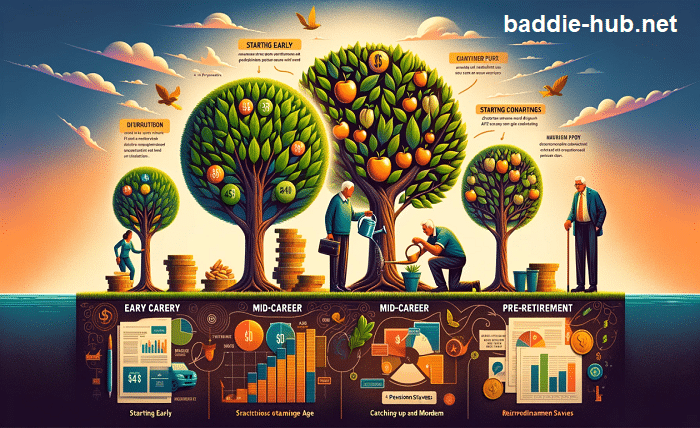

Benefits of Early and Consistent Retirement Contributions

The principle of compound interest states that the sooner contributions start, the more time money has to grow. Early savers can benefit from the exponential growth of their investments over decades. Consistency is equally important, as regular investments over a long period can smooth out volatility in the market, allowing savers to buy more when prices are low and benefit from growth during upturns. Routine saving also helps solidify financial discipline, ensuring that retirement planning is prioritized throughout one’s career.

Moreover, by starting early and contributing consistently, individuals can take advantage of tax benefits each year, reducing their current taxable income and boosting their future retirement savings. This disciplined approach not only maximizes the potential for growth through compounding but also reduces the pressure to save more significant amounts later in life, which may be more challenging due to unforeseen financial responsibilities. Additionally, early and regular contributions allow investors to adjust their investment strategies based on changing market conditions and personal circumstances, optimizing their overall retirement portfolio performance.

Evaluating Risk and Investment Options

Investment risk tolerance varies widely among individuals and can change throughout a lifetime. Younger investors might take on more risk with investment options like stocks or cryptocurrency to maximize potential returns. At the same time, those closer to retirement may prefer bonds or fixed-income investments to preserve capital. Assessment of personal temperament, financial situation, and retirement timeline is thus necessary for choosing investment options that align with one’s comfort level, financial goals, and the need for portfolio liquidity.

Understanding Tax Implications and Benefits

Tax planning is an integral component of retirement strategy. The benefits of tax-deferred growth in accounts such as 401(k)s or Traditional IRAs can be substantial over the long term. Conversely, some funded with after-tax dollars, allow for tax-free withdrawals in retirement, providing tax diversification. Awareness of and utilizing these tax benefits can help craft a retirement savings strategy that maximizes wealth while minimizing tax burdens, both now and in the future.

Employer Matching and Contributions

Employer matching contributions are a form of benefit that should be noticed. By matching a particular portion of employee contributions, employers provide free money to their employees’ retirement funds. Participants should aim to contribute at least the maximum amount their employer will match. Doing so would mean taking advantage of one of the most straightforward ways to boost retirement savings.

Leveraging Professional Financial Advice

While many individuals manage their retirement planning independently, others may benefit from professional advice. Financial advisors bring expertise in investment strategies, tax planning, and asset allocation. Working with a financial professional can help navigate complex financial decisions, align investments with retirement timelines, and mitigate risks associated with market volatility.

Lifecycle Funds and Target-Date Retirement Strategies

Lifecycle and target-date funds offer simplicity for those who prefer a passive approach to investment management. These funds adjust their investment mix based on the beneficiary’s age and expected retirement date, gradually shifting to a more conservative asset allocation. This hands-off strategy can benefit individuals needing more time or inclination to manage their investments actively.

Navigating Social Security Benefits

Social Security remains a staple of retirement income for many. Deciding the optimal time to begin taking Social Security can depend on one’s health, projected longevity, and financial needs. Some delay benefits, which results in higher monthly payments, while others might need the income as soon as they are eligible.